does food have tax in pa

In the state of Pennsylvania sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Pennsylvania Tax Rates Collections and Burdens.

The Tax That Ate Philadelphia The Philadelphia Citizen Business

This page describes the taxability of.

/arc-anglerfish-arc2-prod-pmn.s3.amazonaws.com/public/3UI6CDO245CYBDZCRSSOBLLGH4.jpg)

. The Pennsylvania state sales tax rate is 6 and the average PA sales tax after local surtaxes is. Generally tax is imposed on food and beverages for consumption on or off the premises or on a take-out or to go basis or delivered to the purchaser or consumer when. While Pennsylvanias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

The sale of food and nonalcoholic beverages - by a caterer or eating establishment in Pennsylvania is subject to tax regardless of. Transfers to a spouse or child. Employers with worksites in Pennsylvania are responsible for withholding and remitting Pennsylvania local income taxes.

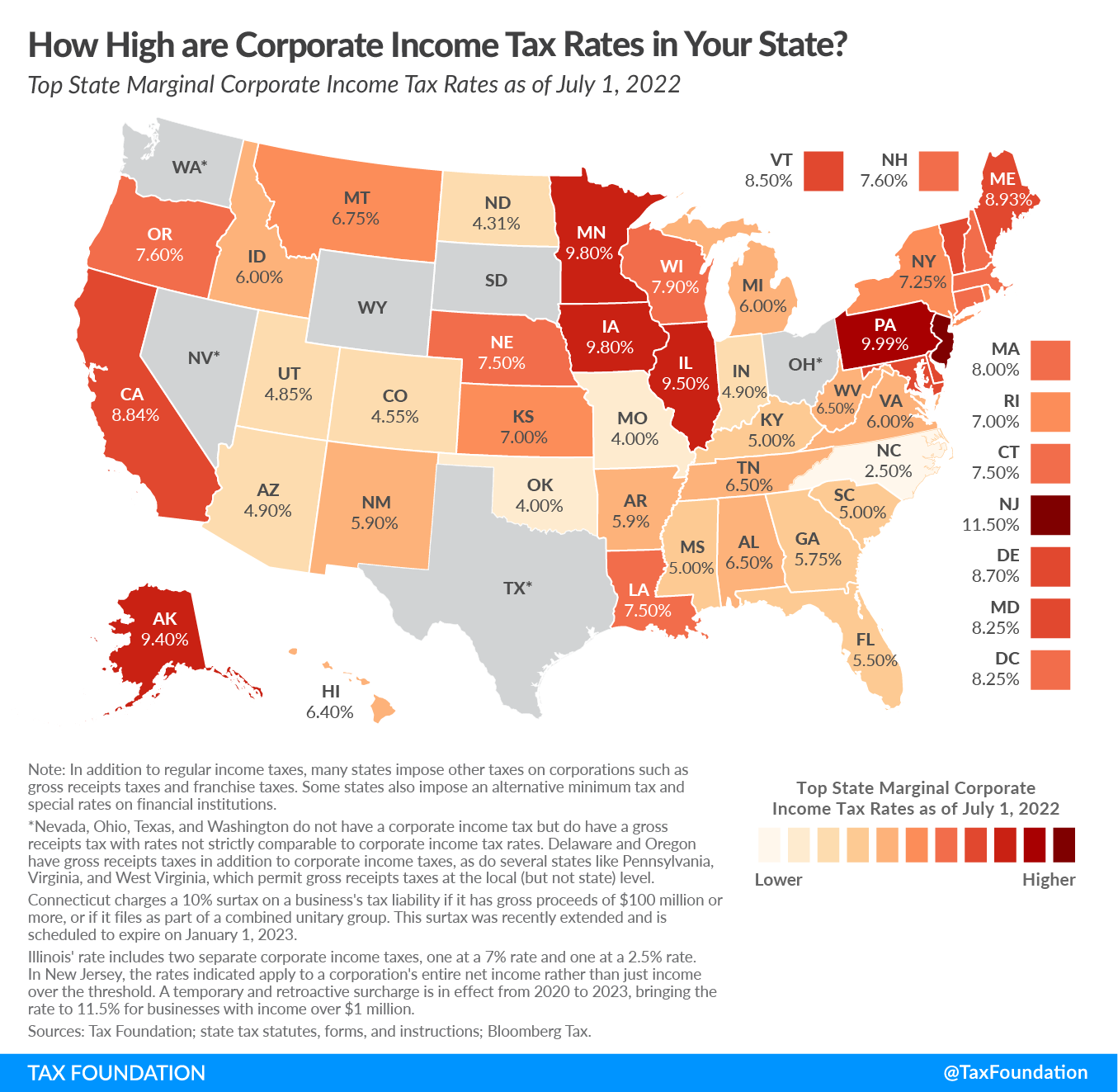

What taxes do you pay in Pennsylvania. Restaurant meals and general purchases are subject to an 8 percent sales tax whereas liquor is subject to a 10 percent sales. Exact tax amount may vary for different items.

Worksites include factories warehouses branches. The Pennsylvania sales tax rate is 6 percent. What is the tax on restaurant food in Philadelphia.

The tax was first imposed in 1935 and has been modified numerous times over the years. Some examples of items that exempt from Pennsylvania. Locally Made Food Shop Coupon Lancasterpa Com Pittsburgh Lawyers Bring Fight To Sheetz Over Sales Tax On Mineral.

Does food have tax in pa Monday October 24 2022 Edit. The information provided on this page is for informational purposes only and does not bind the department to any entity. Pennsylvania does have an inheritance tax that can be as high as 15 percent but it depends entirely on who is receiving the funds in question.

Sales Use Tax Taxability Lists. Pennsylvania has a 600 percent state sales tax rate a max local sales tax rate of. Statutory or regulatory changes.

Pennsylvanias sales tax on food has a long and complicated history. 2022 Pennsylvania state sales tax.

Idaho Tax Returns Offer Donation Opportunity To Idaho Foodbank Fund The Idaho Foodbank

Food Tax Repeal Think New Mexico

Calls To Suspend Gas Taxes In Pennsylvania And Across The U S Grow As Prices Surge 90 5 Wesa

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Tesco Mobile Ads Banned For Replacing Expletives With Food Names

Pittsburgh Lawyers Bring Fight To Sheetz Over Sales Tax On Mineral Water Pennsylvania Record

Pennsylvania Food Merchants Association Home Facebook

Sales Taxes In The United States Wikipedia

States With The Highest Lowest Tax Rates

Food Tax Exempt In Pa Tagged Farm Keystone Sutler

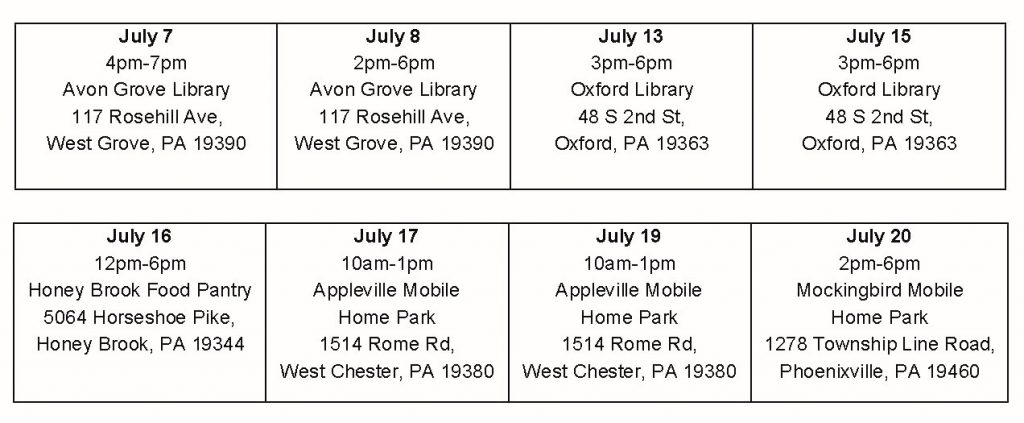

177 Of 177 Successful Tax Appeals In 2019 You Can Help Reach Mobile Home Owners In Chester Co In 2020 Legal Aid Of Southeastern Pennsylvania

Food Sales Tax Elimination Could Be Felt At City County Level Derby News Derbyinformer Com

Everything You Don T Pay Sales Tax On In Pennsylvania From Books To Utilities On Top Of Philly News

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Pennsylvania Sales Tax Small Business Guide Truic

Exemptions From The Pennsylvania Sales Tax

Bidenflation S Cost In Pennsylvania Gop

United Way Of Chester County Will Hold Outdoor Outreach Events For Its Mobile Home Tax Reassessment Program United Way Of Chester County

Pennsylvania Tax Rates Rankings Pa State Taxes Tax Foundation