how to calculate taxes taken out of paycheck in illinois

Our online Weekly tax calculator will automatically work out all your deductions based on your Weekly pay. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

How To Read And Respond To Your Notice From The Irs Irs Reading Internal Revenue Service

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s. Since 142800 divided by 6885 is 207 this threshold is reached after the 21st paycheck. The employees adjusted gross pay for the pay period.

The employees W-4 form and. Illinois Salary Paycheck Calculator. Unlike Social Security all earnings are subject to Medicare taxes.

Paycheck Calculator Take Home Pay Calculator Free Online Paycheck Calculator Calculate Take Home Pay 2022 Illinois Paycheck Calculator Smartasset. Taxable Income in Illinois is calculated by subtracting your tax deductions from your gross income. This free easy to use payroll calculator will calculate your take home pay.

After a few seconds you will be provided with a full breakdown of the tax you are paying. Post-tax deductions are taken out after your income and payroll taxes have been withheld. Employees who file for exemption from federal income tax must still have Medicare taxes.

Calculates Federal FICA Medicare and withholding taxes for all 50 states. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major. Overview of illinois taxes illinois has a flat income tax of 495 which means everyones income in illinois is taxed at the same rate by the state.

Youll use your employees IL-W-4 to calculate how much to withhold from their paycheck. How to calculate taxes taken out of paycheck in illinois. The employee will need the difference paid as retro pay for the 40 hours in the prior period back to the date the raise should have taken effect.

Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding amount its not that easy. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Illinois. How Your Illinois Paycheck Works.

If you earned a pension in 2018 youll need to fill out Form IL-1040 and. A pretax deduction is taken out of your pay before any taxes are withheld so it reduces your taxable income. It can also be used to help fill steps 3 and 4 of a W-4 form.

Employers are responsible for deducting a flat income tax rate of 495 for all employees. Using our Illinois Salary Tax Calculator. Calculate Federal Income Tax FIT Withholding Amount.

No cities within Illinois charge any additional municipal income taxes so its pretty simple to. If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our Taxpayer Assistance Division at 1 800 732-8866 or 1 217 782-3336. To use our Illinois Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Overview of Illinois Taxes Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator.

Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return. Only the Medicare HI tax is applicable to the remaining four pay periods so the withholding is reduced to 6885 x 145 or 9983. For the first 20 pay periods therefore the total FICA tax withholding is equal to or 52670.

Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. The Waiver Request must be completed and submitted back to the Department. Use smartassets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

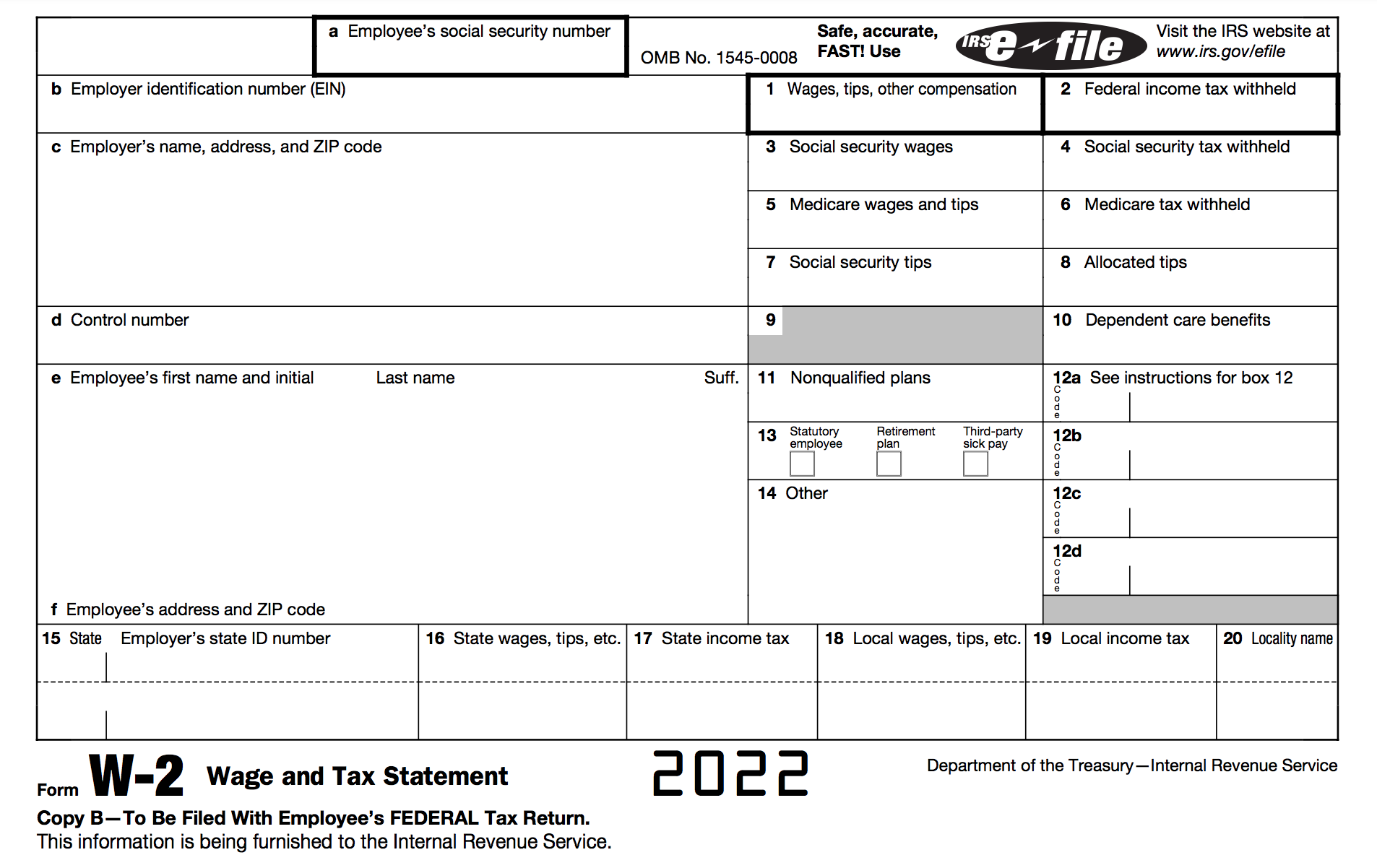

Make sure you have the table for the correct year. To calculate Federal Income Tax withholding you will need. The tax calculator provides a full step by step breakdown and analysis of each tax Medicare and social security calculation.

The first step to calculating payroll in Illinois is applying the state tax rate to each employees earnings. According to the Illinois Department of Revenue all incomes are created equal. This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis.

This calculator is intended for use by US. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. How do I calculate how much tax is taken out of my paycheck.

Employers in Illinois must deduct 145 percent from each employees paycheck. A copy of the tax tables from the IRS in Publication 15. Personal income tax in Illinois is a flat 495 for 20221.

How to calculate taxes taken out of paycheck in illinois Monday March 7 2022 Edit. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

Supports hourly salary income and multiple pay frequencies. For the employee above with 1500 in weekly pay the calculation is 1500 x. Illinois Hourly Paycheck Calculator.

Personal Income Tax in Illinois. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. How Your Paycheck Works.

This means that you get a full Federal tax calculation and clear understanding of how the figures are calculated. Incredibly a lot of people fail to allow for the income tax deductions when completing their annual tax return inIllinois the net effect for those individuals is a higher state income tax bill in Illinois and a higher Federal tax bill. Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Tax Withholding For Pensions And Social Security Sensible Money

2 000 After Tax Us Breakdown April 2022 Incomeaftertax Com

Payroll Tax What It Is How To Calculate It Bench Accounting

Here S How Much Money You Take Home From A 75 000 Salary

How To Calculate Payroll Taxes Taxes And Percentages

New Tax Law Take Home Pay Calculator For 75 000 Salary

What Are Marriage Penalties And Bonuses Tax Policy Center

Illinois Paycheck Calculator Smartasset

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Illinois Paycheck Calculator Adp

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

How To Fill Out A W 2 Tax Form For Employees Smartasset

How Much Should I Set Aside For Taxes 1099

Taxes On Vacation Payout Tax Rates How To Calculate More

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)